They make up excuses why they cant give back the info, thats not listed in your account, that you gave in the first place. Hypocritical justifications to not do work. Do not use this service... they respond with everything I tried and had explained already, deflection!

I've been using this software for the past 2 years without an issue. Federal filing is free and state filing is $14.99 that's a great deal and pretty cheap. I paid with my debit card and I usually receive my refund through direct deposit within 2- 2 1/2 weeks. I'm reading these reviews from everyone else and I'm unsure why everyone is complaining about a fee that's so darn cheap! I've used other services like HR Block and Jackson Hewitt and they always take at least $200+ out of my refund as payment. Free Tax USA is a walk in the park. You guys need to relax. It's a $14.99 fee not a million dollars

Hello Fatima! Thank you so much for your review! We are glad that you found us and look forward to helping you with your returns for years to come.

I tried filing 2020 taxes with these guys and paid 17.98 just for them to inform me that I can't efile a year later and this must be done through mail. I haven't been refunded my money. They made me put my credit card information in before informing me. Basically stole $17.

Hi Stevie, I'm sorry to hear of your payment issues. Please sign in to your account to contact our Customer Support team, or email our support agents at support@freetaxusa.com and we can get you the help you need.

On a positive note, FreetaxUSA is pretty easy to use, only if you don't have but a few documents. There is basically no support. You have to email your question, wait for a response and hope you asked the right questions. The generic response is not helpful. The find extra deductions is lame. First and last time I will use. Paid for the deluxe should have just done the free, with the same outcome. I've used TurboTax. For years, this year they have made filing more difficult so I thought I would try something else. Lesson learned.

Hi Lucy, we are truly sorry you did not receive the Customer Support you had expected. We aim to provide an excellent service for our customers and are sorry we have not met your expectations. Our Deluxe support package includes communicating via live Chat. We would love to see what we can do for you and to see how we can improve. Will you please log into your account and select "Deluxe Support" to begin a chat with us or send us a message. We look forward to hearing from you.

The live chat explains how to tap menu for income to find easy attach info. It works once. But if you need to take a break. And go back to that method the tap menu income no longer contains attach 1099 MRC on it. This is no matter how many times you try this. Very annoying. And your e return will not go in without these attachments even tho your credit card has already been billed as if! More than annoying. Maybe no longer free Turbo has sent them a virus so you go to thinking Maybe you get what you pay for?

Hi Pamela! We apologize for the frustration you are experiencing. It sounds like you are needing to link a 1099-MISC to the return information. We would be happy to further assist you. Please log into your account and contact Support and our Customer Support team would be happy to assist you and guide you through the steps.

The return was free and all, but then when I needed help they were not helpful at all. All I got was "did you call the irs?" "Sorry we don't know" it's been 90 days and I'm about to be evicted in a couple weeks, with no answers. The IRS said they don't have the return but FreeTaxUSA they can't do anything even tho they are the only ones who say the IRS has the return. I haven't had problems in the past but they didn't have some helpful amazing customer service like they advertise.

Hi TC. We are glad to hear you enjoyed the software and preparation process. We do our best to assist customers with their questions regarding the software and their account. Once the IRS system has accepted a return, they do not provide any updates to us regarding the refund status. A very common issue this year is the IRS taking much longer to process refunds for many returns. We are very sorry about the delay with the IRS issuing your refund. Please continue to check the status of your refund using the IRS Where's My Refund tool: https://www.irs.gov/refunds Please be sure to verify the information being entered matches exactly with your return.

I've used FreeTaxUSA several times to do my taxes, and have always been quite satisfied with the results. The interface is pretty straightforward and easy to navigate. And even if you decide not to pay the $15 to file your state taxes, the program still tells you the amount you owe the state or vice versa.

Overall, I find the experience simple and effective, and would recommend this site to others.

Hi Don, thank you for your feedback. We are happy to hear of your positive experiences with our software. Thank you for taking the time to share!

Used it for the first time to file my sole member llc. Seemed pretty simple and straight forward. I e-filed my federal and state taxes, however, I incorrectly entered my date of birth. It immediately got rejected for e-file. I got an email from FreeTaxUSA to try again. I fixed the issue and it went smoothly. I liked it. The only reason I wouldn't give it 5 stars is that, it was a bit confusing when filing for my llc. I like this business though and will definitely be using FreeTaxUSA in the future.

Thanks for the review, Guy! We are always looking for ways to improve the tax-filing experience for our customers and would like to know how we can improve. Can you send details about what was confusing to support@freetaxusa.com?

I am retired rrr. Never received any payment from social security. However part of rrr is listed as social security equivalent. The rest as pension. They threw the whole thing in as social security and can't get hold of anyone at the Free tax USA or IRS to correct

Hello Fred. We are very sorry for the frustration you have had with your pension entry. Can you please log in to your account and click on the Support link? Our friendly and knowledgeable support staff is always happy to assist you via email free of charge. Your message will go to a live person, who will respond within a few hours. We also offer a live chat support option if you would like to upgrade to the Priority Support version of the software.

We are a typical retired couple. Our taxes include social security, W2 income, stock sales, mutual funds, home interest payments, etc... nothing overly complicated. I used TaxAct/TurboTax for over 20 years and was not dissatisfied, but they kept increasing their charges, so I looked for another provider. Let's just say that I am glad I did! I uploaded my prior year taxes (pdf file) and everything came across without error! I found the web interface to be easier to use than TaxAct and I was not charged extra for having investments. Assuming everything comes back with IRS approval, I will be back again next year. Great product!

Hello Jim! We're so glad you had a good experience using our software! We really appreciate the positive feedback and hope to see you back next year.

Your mileage may vary.

There software is not designed to handle IRA contributions accurately including reporting of Basis for a non taxable IRA contribution on form 8606 Line 1.

So if their software is inaccurate here it could be in other places too.

Don't recommend using

Hello, JS! Line 1 of Form 8606 is used to report nondeductible contributions to a traditional IRA. In order to claim a nondeductible contribution, you would need to first qualify for the contribution. So, if you don't see your contribution on line 1 of Form 8606, it's possible that you do not qualify - which could be for one of several reasons. We guarantee the accuracy of all of our calculations and would be happy to take a look at your return to see why your contribution is not showing on line 1 of Form 8606. Please sign in to your account and click the "Contact Support" link.

Just got a bill for $700 more than I paid, IRS says due to error in filing. Always used turbo tax before with no issues never owed more than return said. Already paid $400, not sure where the error is, entered all info correctly.

Hello! Our Customer Support team would be happy to look into this. We guarantee our software to be accurate based on your entries. Please log in to your secure account and click on the "Support" link to get in touch with them.

I have no problem with the filing, however if you need to get back into your account nothing matches... username password sec questions... I have contacted support a month ago & Im still waiting... would be better if there was a phone # for support or online chat help. I used this site for 2 years & probably wont use it again...

Used yea last year without any issues. I completed everything including authorizing payment from my bank account for preparation of state tax. I was unable to complete final step, no PIN number. The site says just log out and complete later. What a sucker I am, my' user name. Password or security answers' are being rejected. My taxes are sitting in LIMBO and my bank account is a little smaller. They send e-mail notices that I need to complete it, but they will not respond to my appeal for help. I will not use them again next year...

We have used freetaxusa.com for 8 years now. It conveniently remembers all of our information from year to year so everything is ready to go. This year, I actually used my cell phone to complete our taxes, and I was finished in less than 15 minutes! I can hardly believe that places like H & R block are still in business. I finished my taxes faster than the time it would take me to even drive to my nearest H&R. The IRS sent emails, from both federal and state, saying that my return was accepted within 4 hours of processing them. Each year, our refunds arrive within 7 days and I expect no less this year. I love this user friendly site... it makes filing taxes a piece of cake!

I've used FreeTaxUSA for several years and have not had any problems. I used to file my state taxes separately to avoid paying for it but my state made their tax forms even more complicated. So, I gave up on that and pay the $10. My time is worth more than that.

In general, I've found it extremely easy to use! I also like that I can look at previous returns.

My only problems, which may actually be more of an inconsistent "division of taxation" problem, has to do with the W2 information not exactly matching the fill-in boxes.

I have been using this site for 9 years now and so have my friends. Everything was fine until a couple of years ago. After putting in all our info when we get to the end it tells us that our returns have to be mailed in but doesn't give us a reason why. Problem number 2 we cant file our state returns because our credit/debit cards are being declined when we actually have money on them. I contacted support one time and they basically told me there was nothing they could do and to go file my state at our local tax place. So last year after I was told by their site that I had to mail my return in for unknown reasons I filed my return with Turbo Tax and it went straight through with no problems! I will never use this site again and I have advised all my friends and family as well! Scam!

Hi Janisha, we are always concerned when a customer feels things didn't go as smoothly as they should have. We’ve been helping customers successfully prepare and e-file their tax returns since 2001. It’s rare, but there are times when a return has to be mailed. In these cases our support staff is always there to help you work through these kinds of issues or provide you with your alternatives.

For a year of pandemic and relief packages Free Tax USA makes it hard. You have to pay 14.99 before you can even file an amended return when tax services such as H&R and turbo tax (which are way more advanced in software) are free! Who the hell wants unlimited amended tax returns? We just want to file so we can get our damn money! I definitely will be going elsewhere to file my taxes next year!

Hello, Tasia. At FreeTaxUSA, we offer comprehensive and user-friendly federal tax preparation software, which is 100% free to use, no matter how complex your tax situation may be. In addition to this free service, we do offer other optional products at competitive flat rates, with transparent pricing available on our home page. These additional services include the ability to prepare as many amended returns as you need. You are always free to try out those services to see if they are a good fit for you, before you pay anything. Many taxpayers who filed early this year have found they are not required to submit an amended return in order to take advantage of recent tax law changes. If you have questions about your own situation, our customer support team would be happy to help. Please reach out to them by signing in to your secure account and clicking on the Support link at the top of the screen.

Says free free til the end then because i was filing 2018 taxes which system allowed til the end then wants credit card which im not putting on here and then charges for state filing 14,99 like really? If i could print them i would have used diff site. I was looking to efile then when u view your return it has do not process until u give cc info or paypal info not happening. So now here i am not knowing what to do i hope no foreigners start calling me either i dont need the crap thanks for nothing

Hi Kimberley,

At FreeTaxUSA, we offer federal software that is easy to use, and 100% free. We do charge a small fee to prepare your state return. The prior year state return fee is for the preparation and calculations of the return and associated forms. We are very sorry for any misunderstanding. The IRS does not accept prior year returns through e-file so they do have to be mailed. I can also assure you the information entered will not be shared and will be kept secure. You can view our Privacy Statement at the following link: https://www.freetaxusa.com/privacy.jsp If you need further assistance with this, one of our customer service agents would be happy to look into this further. Please log into your account and click on Contact Support.

I have been using freetaxusa.com for about 12 yrs now. I had never had an issue filing my fed or state tax. The fed is 100% no matter if you got schedule C or dependents. I use a 10% off for state. Which I only pay $11.65 every year. My whole family uses freetaxusa.com. It's quick and easy. One of the best parts is that you don't have to pay $25 to pull previous years returns. Its free. Instructions are so easy, they guide you thru the whole process. I hope freetaxusa don't change.

Q&A (220)

I did my taxes today there, first it says no state tax refund then it made me pay 12.95 to expedite my refund? Then every credit card I tried said turned down do too late payment even my debit which has no payments I am not late, I am feeling this was a ploy to get all my credit card numbers?

Answer: Hi Janet, sorry for any confusion. The $12.95 fee is for state tax return preparation whether the tax return is e-filed or printed and mailed. In regard to your difficulty paying. When you make a debit or credit card purchase online, the card processor checks with your bank or credit card issuer to first make sure you have enough available credit to complete the purchase. The card processor then makes sure the other information you input (for instance, your address) matches what your bank has on record. If all is well, the transaction is processed. If not, such as an address that doesnt match, then the transaction is declined. If you were having difficulty with each card, I would recommend double checking the billing information you entered on FreeTaxUSA. If thats all correct, I would contact your bank and make sure the information they have on file is up-to-date. If youre ever having trouble while using our site, you can click on the Contact Support link or email our customer support team at support@freetaxusa.com and a support team member will be happy to assist you.

I need to make some changes on the tax return I'm working on but cant find anywhere to change my figures Where can I go to make the changes?

Answer: Hi Theresa! If you have not submitted your taxes and need to make changes, you can use the tabs near the top of the screen (Personal, Income, Deductions/Credits, etc.) to navigate to the area you want to make changes. If you've already filed, you'll need to amend your taxes in order to make changes. Our support agents would be happy to give more information for either case. You can contact them by selecting "Support" in your account.

Could I please get a phone number?

Answer: Hi Mahlon, we are happy to help you with your questions. I'm sorry but we do not have phone support at this time. If you need some help you can contact us at support@support.freetaxusa.com

I completed my 2022 Fed & State returns but after I paid I was informed I would have to mail the returns. I cannot get a copy of my returns.

Answer: Hi Byron, thank you for reaching out. We are sorry to hear of the frustrations you are experiencing. Once the state return has been paid for and the return is finalized the returns are available for you to print. Would you please sign into your account and select to contact Support. This will allow us to assist you best.

Can i have the completed taxes sent out by freetaxusa themselves, or do i have to copy them and mail them myself?

Answer: Hi Peter. Thank you for your question. FreeTaxUSA is unable to mail your return for you. However, if you choose to mail your return on the Filing Method screen found under the Filing menu, our software will tell you how/where to mail your return. You can print a copy of your federal tax return for free on the Check Status/Print Tax Return screen also found under the Filing menu. If you don't have a printer and would like to order a printed copy, you can do that on the Order Products and Services screen found in the same menu.

Will software work with Chrome operating system?

Answer: Hi, Sean! That's a great question. Our software is entirely browser-based, so it will be compatible with any operating system running a major browser. This includes Chrome, Edge, Safari, iOS, and Firefox.

Why has it been so long since I filed my taxes (over 3 weeks) for me to receive my refund from both Federal and State 2022?

Answer: Hello Linda. I am sorry you have not yet received your tax refund. The IRS typically issues the refund in about 21 days. However, this is just an average and not a rule. Please check the status of your Federal refund at www.irs.gov/refunds. Your state will also have a similar site where you can check the status of your refund. If you have any questions after you have checked the status of your refunds, please sign into your FreeTaxUSA account and click on the Contact Support menu option.

I want to do my 2021 and 2022 taxes do I do this together? And e-file is free?

Answer: Hello Shannon! Yes, you can prepare both your 2021 and 2022 taxes using our software, but you will enter each year's information separately in each year's software. Current year taxes can be e-filed, and prior year taxes will need to be mailed. There is no charge for e-filing, but we do have additional products available (such as State Tax Returns) for an additional cost. Our support agents would be happy to answer any additional questions at support@freetaxusa.com.

Have a question?

Ask to get answers from the FreeTaxUSA staff and other customers.

Overview

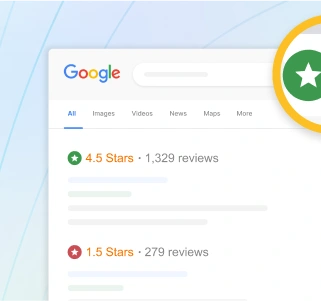

FreeTaxUSA has a rating of 2.2 stars from 288 reviews, indicating that most customers are generally dissatisfied with their purchases. Reviewers dissatisfied with FreeTaxUSA most frequently mention state taxes, last year and customer service. FreeTaxUSA ranks 1st among Tax Preparation sites.

Each tax year, a team of tax analysts updates the software to the latest federal and state standards. The software incorporates new credits, deductions, and changes to the tax code. Once the software is updated, it goes through a rigorous testing and approval process with the IRS and each state. This ensures the software is ready for the new tax season.

FreeTaxUSA is 100% made in America. All customer service representatives live and work in the United States. When you file your taxes with FreeTaxUSA, you are supporting American families and creating American jobs.

We don’t provide tax advice, account specifics, or customer support through SiteJabber. The safest and quickest way to get support is to sign in to your FreeTaxUSA account and click on the ‘Contact Support’ link. You can also click on the ‘Support’ link at the top of the FreeTaxUSA.com homepage.

- Visit Website

- Provo, UT, United States

- Edit business info

Business History

Company Representative

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

Hi Jeffrey, we apologize for the frustration you've experienced. We do our best to provide customers with what they need. We are happy to assist you further. Would you message us your email address and we will be happy to follow up with what is going on and what you need, or you can log into your account and contact Support with your questions.